Gardner Ma Property Tax Bills . Each year the city must have its tax rate approved by the massachusetts. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1. any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. search our database of free gardner residential property records including owner names, property tax assessments &. here you will find helpful resources to property and various excise taxes administered by the massachusetts department of revenue (dor) and/or.

from pay.eb2gov.com

here you will find helpful resources to property and various excise taxes administered by the massachusetts department of revenue (dor) and/or. search our database of free gardner residential property records including owner names, property tax assessments &. any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. Each year the city must have its tax rate approved by the massachusetts. reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the.

EB2Gov EPay

Gardner Ma Property Tax Bills any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. search our database of free gardner residential property records including owner names, property tax assessments &. Each year the city must have its tax rate approved by the massachusetts. here you will find helpful resources to property and various excise taxes administered by the massachusetts department of revenue (dor) and/or. reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1.

From rmofstclements.com

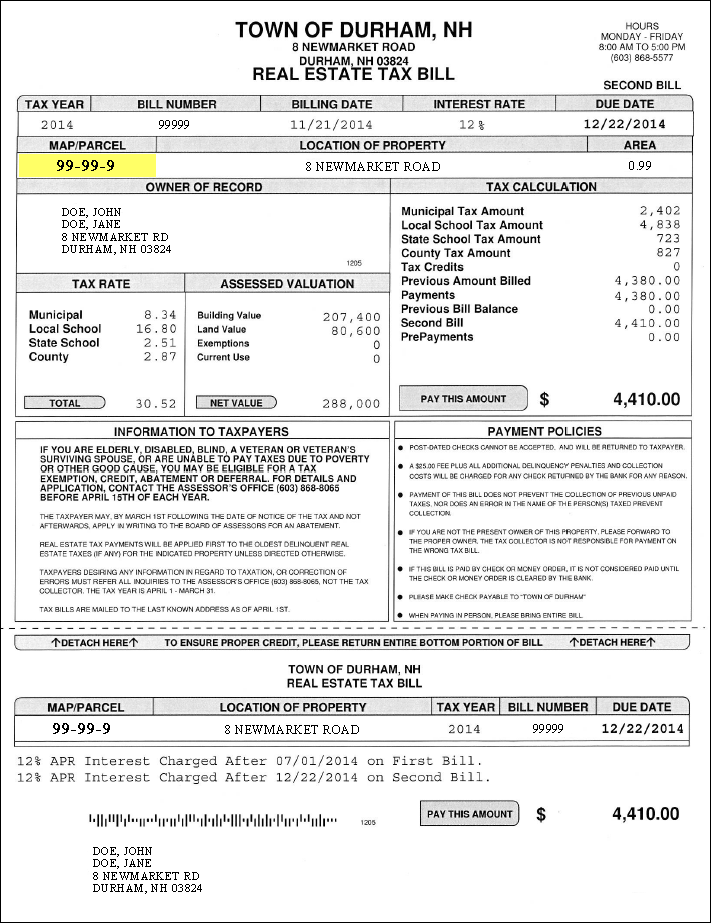

Sample Tax Bill Rural Municipality of St. Clements Gardner Ma Property Tax Bills here you will find helpful resources to property and various excise taxes administered by the massachusetts department of revenue (dor) and/or. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. any property owner in massachusetts has online access to the deed to their property and. Gardner Ma Property Tax Bills.

From exouaedjw.blob.core.windows.net

Hamilton Ma Property Tax Rate at Susan Erhart blog Gardner Ma Property Tax Bills Each year the city must have its tax rate approved by the massachusetts. any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners. Gardner Ma Property Tax Bills.

From dxotuvuvt.blob.core.windows.net

How To Find Your Property Tax Bill at Scott Slane blog Gardner Ma Property Tax Bills Each year the city must have its tax rate approved by the massachusetts. search our database of free gardner residential property records including owner names, property tax assessments &. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. any property owner in massachusetts has online access. Gardner Ma Property Tax Bills.

From dxotuvuvt.blob.core.windows.net

How To Find Your Property Tax Bill at Scott Slane blog Gardner Ma Property Tax Bills due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. search our database of free gardner residential property records including owner. Gardner Ma Property Tax Bills.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Gardner Ma Property Tax Bills Each year the city must have its tax rate approved by the massachusetts. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1. any property owner in. Gardner Ma Property Tax Bills.

From tax.ny.gov

Sample Property Tax Bills Gardner Ma Property Tax Bills search our database of free gardner residential property records including owner names, property tax assessments &. here you will find helpful resources to property and various excise taxes administered by the massachusetts department of revenue (dor) and/or. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will.. Gardner Ma Property Tax Bills.

From www.wcvb.com

Mass. towns with lowest property tax bills Gardner Ma Property Tax Bills search our database of free gardner residential property records including owner names, property tax assessments &. Each year the city must have its tax rate approved by the massachusetts. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. any property owner in massachusetts has online. Gardner Ma Property Tax Bills.

From www.montgomerycountymd.gov

Real Property Tax Prepayment Gardner Ma Property Tax Bills reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1. Each year the city must have its tax rate approved by the massachusetts. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. due to a. Gardner Ma Property Tax Bills.

From gardnermagazine.com

Gardner MA News November 2022 Gardner News Magazine Local News Gardner Ma Property Tax Bills any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. Each year the city must have its tax rate approved by the massachusetts. here you will find helpful resources to property and various excise taxes administered by the massachusetts department of revenue. Gardner Ma Property Tax Bills.

From joeshimkus.com

2024 Berkshire County Massachusetts Property Tax Rates Map Includes Gardner Ma Property Tax Bills Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. Each year the city must have its tax rate approved by the massachusetts. any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax. Gardner Ma Property Tax Bills.

From publiqsoftware.com

Understanding Your Property Tax Bill PUBLIQ Software Gardner Ma Property Tax Bills here you will find helpful resources to property and various excise taxes administered by the massachusetts department of revenue (dor) and/or. any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. reminder from the collector, fiscal year 2024 real estate and. Gardner Ma Property Tax Bills.

From sftreasurer.org

Secured Property Taxes Treasurer & Tax Collector Gardner Ma Property Tax Bills due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. search our database of free gardner residential property records including owner names, property tax assessments &.. Gardner Ma Property Tax Bills.

From www.sheboyganwi.gov

Important Payment Info on Property Tax Bills Gardner Ma Property Tax Bills Each year the city must have its tax rate approved by the massachusetts. reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. search our database. Gardner Ma Property Tax Bills.

From douglastax.org

How to Read and Understand your Property Tax Bill Gardner Ma Property Tax Bills reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1. Each year the city must have its tax rate approved by the massachusetts. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. due to a. Gardner Ma Property Tax Bills.

From my-unit-property-9.netlify.app

Property Tax Bill Images Gardner Ma Property Tax Bills any property owner in massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. here you will find helpful resources to property and various excise. Gardner Ma Property Tax Bills.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Gardner Ma Property Tax Bills Each year the city must have its tax rate approved by the massachusetts. due to a slight conflict in the way the laws regarding municipal taxation are set up, gardner property owners will. reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1. here you will find. Gardner Ma Property Tax Bills.

From dxoytcxmf.blob.core.windows.net

Real Estate Tax Bill Massachusetts at Carlos Tramel blog Gardner Ma Property Tax Bills Each year the city must have its tax rate approved by the massachusetts. Cash, check or credit card, pay at the tax collector’s office, gardner city hall, or the kelly and ryan office at the. reminder from the collector, fiscal year 2024 real estate and personal property fourth quarter tax bills are due may 1. search our database. Gardner Ma Property Tax Bills.

From www.vrogue.co

How To Read Your Property Tax Bill Property Walls vrogue.co Gardner Ma Property Tax Bills here you will find helpful resources to property and various excise taxes administered by the massachusetts department of revenue (dor) and/or. Each year the city must have its tax rate approved by the massachusetts. search our database of free gardner residential property records including owner names, property tax assessments &. any property owner in massachusetts has online. Gardner Ma Property Tax Bills.